The Smartest Way to Find HTS Codes & Calculate Duty

If there’s one thing that keeps importers up at night, it’s "landed cost." You’ve sourced the perfect product, but if you miscalculate the import duty—or worse, pick the wrong HTS code—your profit margin can vanish before the container hits the water.

Navigating the Harmonized Tariff Schedule (HTS) used to mean scanning massive PDF tables and guessing which category your product fit into.

That ends today.

Don't Know Your Code? We’ve Got You. Most calculators assume you already speak "customs broker." We don't.

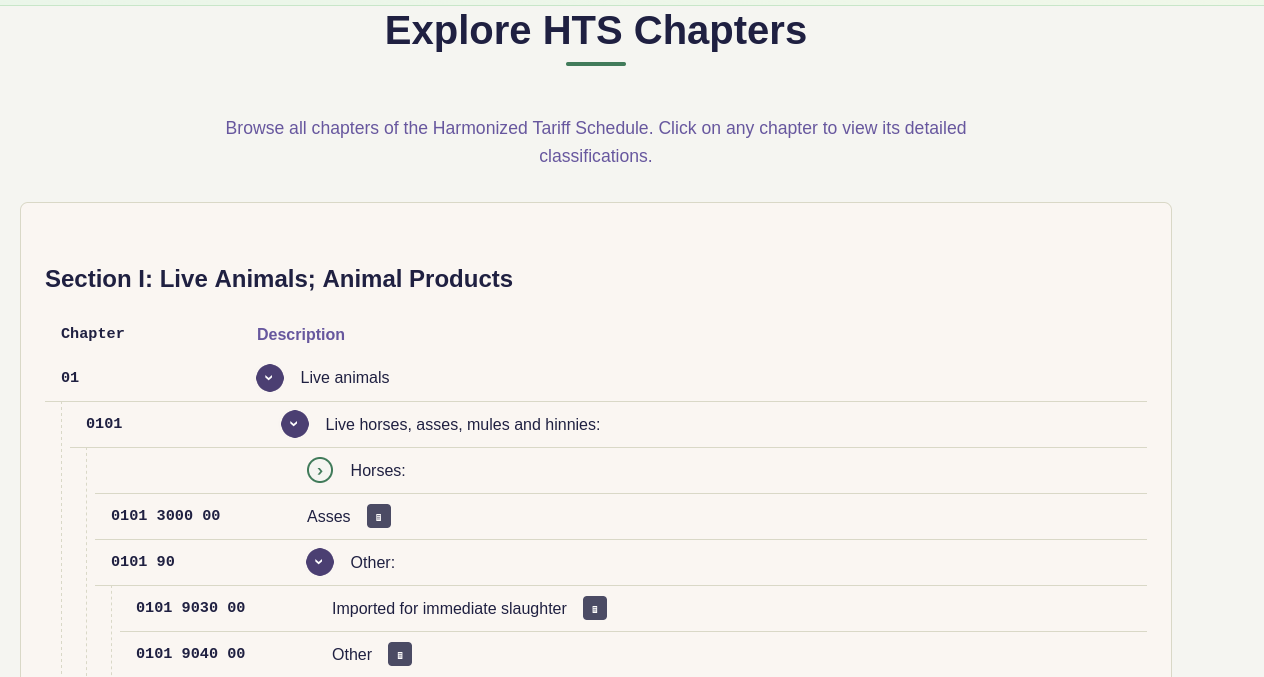

If you don't have your 10-digit HTS code handy, just head to the Explore HTS Chapters section on portoria.app. We’ve digitized the entire schedule into an easy-to-navigate hierarchy.

- Browse: Drill down from Sections (like "Live Animals") to specific Chapters.

- Pinpoint: Find the exact 10-digit classification that matches your goods.

- Click & Go: See that little calculator icon next to the code? Click it.

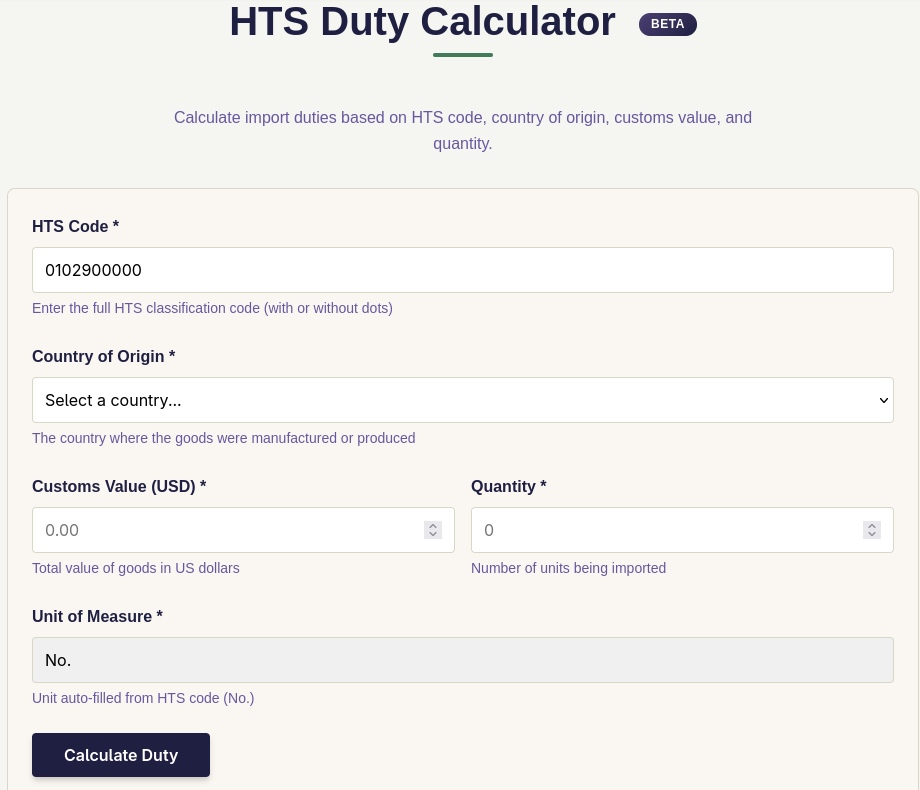

Seamless Automation This is where the magic happens. When you click that calculator icon, you aren't just sent to a blank form.

The system automatically redirects you to the Duty Calculator and pre-fills the HTS code and the correct Unit of Measure.

No copy-pasting errors. No guessing if you need "kilograms" or "liters." You just enter the value and country of origin, and we handle the math.

Why This Workflow Matters

- Accuracy: Reduces manual entry errors.

- Speed: Go from "I have no idea what my code is" to "I know exactly how much duty I owe" in under a minute.

- Clarity: Compare different HTS codes side-by-side to see how slight product changes might lower your duty rate.

FAQ: Mastering Your Duty Costs

Q: Can I still use the calculator if I already know my code?

A: Absolutely. You can jump straight to the calculator page and type it in manually. But if you ever need to double-check a description, the Explorer is one click away.

Q: Why does "Country of Origin" change the price so much?

A: Trade agreements and trade wars. Importing a widget from Vietnam might be duty-free, while the same widget from another country could carry a heavy tariff. Our tool highlights those differences instantly.

Q: Is "Customs Value" just the price I paid?

A: Generally, yes—it's the transaction value (FOB). Just remember to exclude international freight and insurance for the most accurate estimate.